Control Pricing Risk.

Protect Value.

Perform at Scale.

Used Across Mid-Market to Multi-Billion-Dollar Private Equity and Enterprise Portfolios

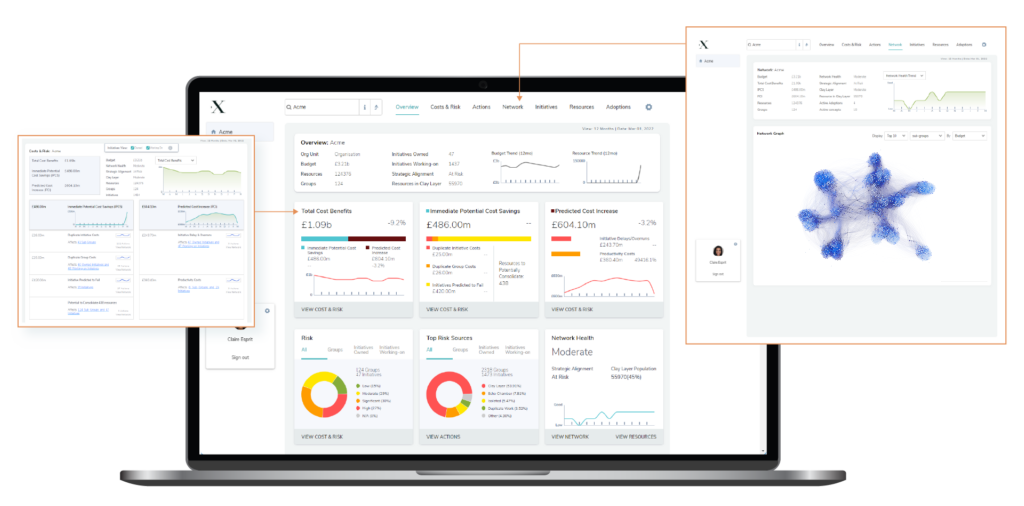

GainX Control for due diligence and pricing risk.

GainX Perform for performance monitoring, predictions, and post-close value creation.

GainX quantifies price risk in due diligence – fast

GainX Control surfaces structural, behavioural, revenue, and delivery risks that distort deal value – before you acquire

Built for due diligence speed and precision, GainX Control delivers quantified insights within 48 hours of receiving data

GainX Control doesn’t just surface hidden execution risk – it generates targeted, insight-led Due Diligence questions tied directly to structural, behavioural, and operational factors that distort pricing. Deal teams gain a level of visibility often unavailable to the target company itself – strengthening valuation confidence, accelerating validation, and improving negotiating precision.

GainX predicted 71% of projects marked “on-track” would delay—and 67% did, costing over 400 person-days.

GainX Perform delivers what PE and enterprise leaders can’t get anywhere else: organisation-wide, systemic insight with drill-down precision – in seconds. It pinpoints execution breakdowns before they hit performance metrics, enabling intervention long before value erodes. This level of foresight and specificity creates a material advantage in identifying and protecting enterprise value – especially when every multiple counts.

With over a decade of R&D, millions in funding from the Canadian government, and recognised as a top innovator by the UK & US governments, also by Microsoft, Thomson Reuters, the Financial Times, Forbes, and more—GainX is built on a mature AI foundation: grounded, validated, and enterprise-proven.

Our proprietary algorithms are informed by five core scientific disciplines, creating an unmatched ability to detect and solve deep systemic issues.

Social Network Analysis

A math-heavy sociology discipline used to uncover how influence, decisions, and information actually move through an organization.

Anthropology

Brings a systemic lens to understand how an organization functions beneath formal structures, surfacing hidden risk and behavioural dynamics.

Behavioural AI

Models the patterns of human behavior that affect execution, productivity, and strategic success – enabling targeted, high-impact interventions.

Machine Learning

Combines network and language models to generate predictive insight, flagging risks to strategy, delivery, and customer outcomes.

Natural Language Processing

Extracts meaning and patterns from unstructured data to map the flow of communication and identify early signals of friction or misalignment.

Privacy

GainX works closely with clients to ensure full respect for privacy and data protection, with strict data governance mechanisms.

Managing Bias

GainX employs consistent standards and methodologies when creating our AI including regular checkpoints and oversight for countering and eliminating potential bias.

Transparency

GainX commits that every machine action or decision by the AI platform will be transparent and explainable.

Security

GainX has strict standards which govern the security, access, use, and retention of all data at GainX (data belonging to GainX, customers, and 3rd parties).

Fairness

GainX reveals a systemic picture of the organisation, limiting insights and views at the group level.

Human-in-the-Loop

The GainX system is, by design, human-in-the-loop. The system provides insights that are actioned by a human only.

In private equity and enterprise transformation, timing and precision are everything. GainX delivers both. Backed by a decade of scientific R&D – spanning behavioural AI, network science, and systems thinking – GainX surfaces early warnings, precision insights, and targeted actions to protect and accelerate value.

Whether you’re pre-close or deep into post-acquisition execution, we’ll send you tailored material to match your needs – real-world case studies, sample due diligence questions, or platform insights.